Mortgage Rates Dip Again: What Homebuyers and Investors Should Know This Week

As of Monday, June 23, 2025

Source: Bankrate.com

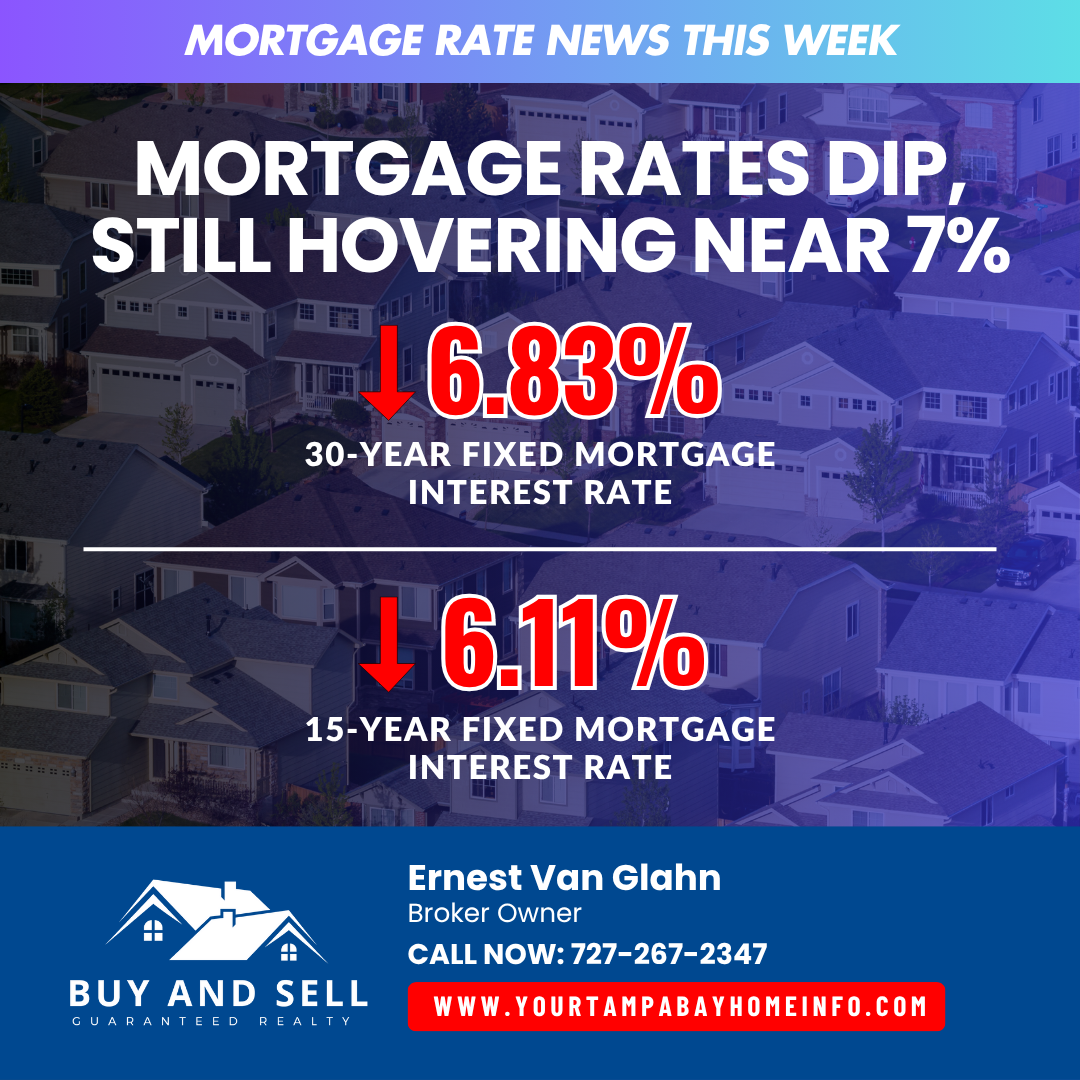

This Week's Average Mortgage Rates:

- 30-Year Fixed Mortgage: 6.83% (↓ 6 basis points from last week)

- 30-Year Fixed Refinance Rate: 6.82% (↓ 8 basis points)

- 15-Year Fixed Mortgage Rate: 6.11% (↓ 2 basis points)

While rates are still hovering near 7%, the slight decline offers a window for smart borrowers to lock in a better deal—especially in today’s complex and competitive lending environment.

Mortgage Market Overview

According to Bankrate's most recent lender survey, the average 30-year fixed-rate loan sits at 6.86%, a modest drop that reflects broader market movements.

What’s Behind the Dip?

- Federal Reserve Pause: The Fed is holding steady on rates amid global economic uncertainty, including trade policy concerns.

- 10-Year Treasury Yields: Typically a bellwether for mortgage rates, Treasury yields dipped below 4% but rebounded to about 4.4%, still pressuring mortgage rates lower.

- Inflation Cooling: Inflation was reported at 2.4% in May—near the Fed’s 2% target, but not quite there, keeping the rate environment in flux.

Product Highlight: DSCR 0.5 Ratio Loan

For investors, there's a notable financing option on the table:

Debt Service Coverage Ratio (DSCR) Loan – as low as 0.5 Ratio!

✅ 680+ FICO required

✅ 25% minimum down payment

✅ Designed to help investors qualify with more flexibility

This type of loan could be a game-changer for property investors who want to expand their portfolios without traditional income documentation barriers.

How to Lock in the Best 30-Year Mortgage Rate

Even with today's rate movement, it pays to be proactive and strategic. Here are some key steps:

- Evaluate the Term: While 30-year mortgages are the most common, explore amortization options from 8 to 29 years.

- Get Pre-Approved: Secure quotes from at least three lenders—on the same day—to make an accurate comparison.

- Compare Interest Rate & APR: Look beyond the rate—APR includes fees, points, and total loan cost.

- Review Lender Reputation: Service matters. Look for responsive communication, flexibility, and positive reviews.

✔️ Pros and Cons of a 30-Year Mortgage

Pros

- Lower monthly payments

- Predictable housing costs (with a fixed rate)

- Increased purchasing power

- Greater financial flexibility

Cons

- Higher total interest paid over time

- Slower home equity growth

- Risk of overextending your budget

- Higher rates compared to shorter-term loans

Whether you're a buyer ready to house hunt, a homeowner eyeing a refinance, or an investor seeking your next property—this is a market where knowledge is leverage.

Rates remain volatile, but opportunities still exist. With the right strategy and guidance, you can navigate today’s market smartly—and potentially save thousands over the life of your loan.

📞 Call, text or email Ernest Van Glahn today: 727-267-2347

🔗 FB page: www.facebook.com/BuyAndSellGuaranteedRealty

📸 Instagram Page: www.instagram.com/yourhomesoldguaranteedtampa

🌐 Website: www.yourtampabayhomeinfo.com

#FLRealtor #SpringHillFL #RealEstateSuccess #DreamHome #BuyAndSellGuaranteedRealty #BuyAndSellGuaranteedRealtyServices #BuyAndSellTeam #ErnestVanGlahn #BuyAndSellGuaranteed #LandOLakes #LoveYourNewHomeOrWellBuyItBack #BuyThisHomeWellBuyYours #RealEstateGoals #HomeSweetHome #WesleyChapel

Categories

- All Blogs (743)

- 15 Must-Ask Questions Before You Buy That House (1)

- 24th Anniversary of the Attack (1)

- 5 Star Review (5)

- 7 Seconds (1)

- Back on The Market (1)

- Back The Blue (14)

- Back To School (1)

- Buyer (12)

- Buyer Guarantee (2)

- Buyers Stop Paying Rent (2)

- Cash Offer (21)

- Commission (4)

- did you know (15)

- Divorce, Death, or Diapers — Life Happens. (1)

- Father's Day 2025 (1)

- Flip Your Own Home (1)

- Floor Plan (1)

- Free Market Analysis (2)

- Fun and Festive (27)

- Hispanic Heritage Month (1)

- Holidays (10)

- Home Buying Tips (6)

- Home Equity (1)

- Home Inspection (7)

- Home Purchase (24)

- Home Sale (16)

- Home Selling Ti (1)

- Home Selling Tips (4)

- Hotlist of Homes (16)

- Independence Day (2)

- Inspection Traps (3)

- Just bought (1)

- korean war (1)

- Meet Your New Favorite Dish (2)

- Military (6)

- Mortgage (11)

- National Day (4)

- National Hire a Veteran Day (1)

- National PTSD Awareness Day (1)

- New Construction Homes (2)

- Pending Buyer (1)

- Price Reduced (1)

- Rebate (6)

- Seller (3)

- Seller's Divorce (2)

- St Thomas Day (1)

- Testimonial (1)

- Thisorthat (4)

- Tunnel To Towers (13)

- Veteran (2)

- We’d Love to Hear From You! (1)

- Wear Red Friday (14)

- What’s Your Home Really Worth? (1)

- Worthy Cause (15)

- 📍 3415 Clover Blossom Cir | Land O’ Lakes, FL (1)

- 🎮 It’s National Video Game Day! (1)

Recent Posts