Did You Know? Rising Insurance and Property Taxes Are Impacting Homeowners

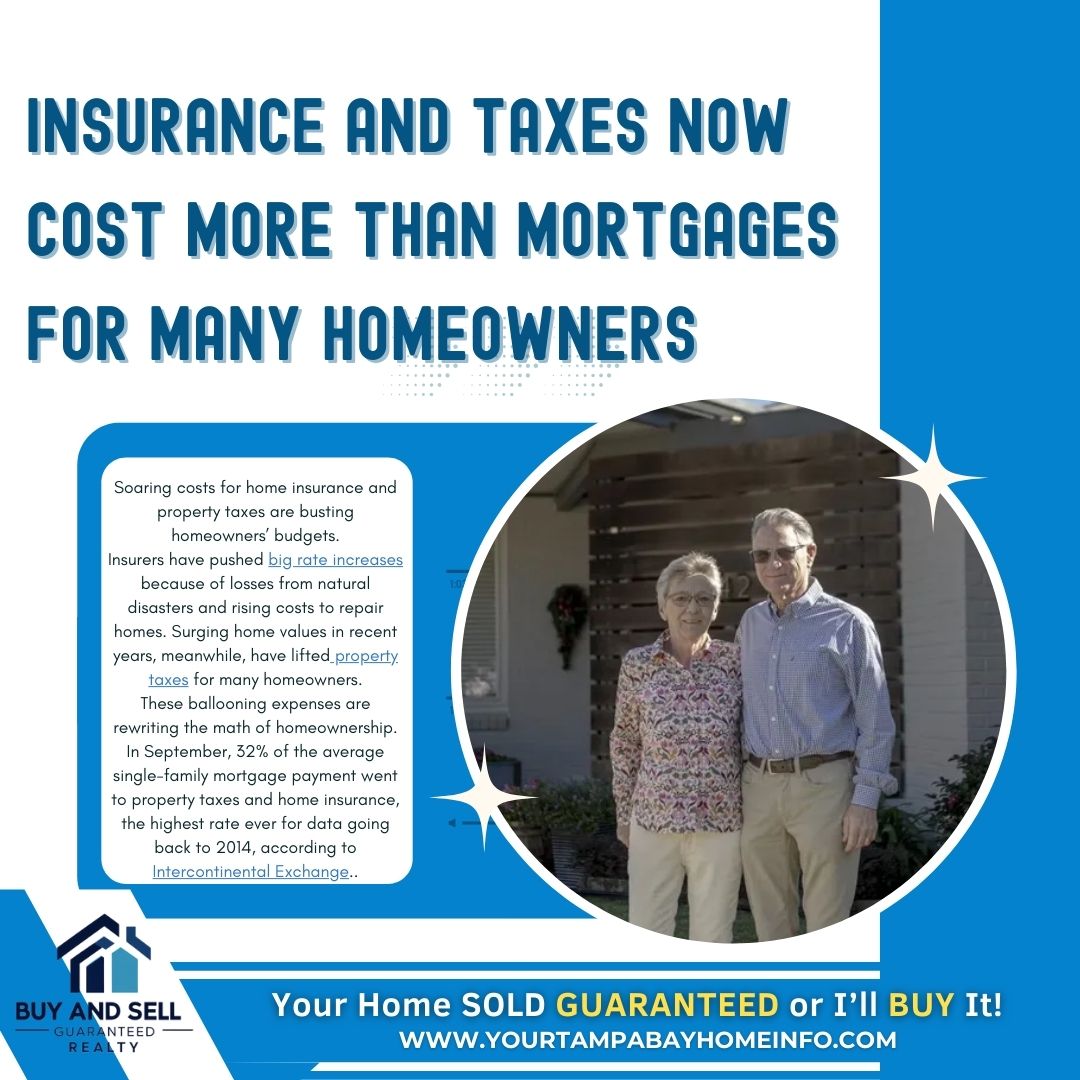

For many homeowners, the cost of insurance and property taxes now exceeds their monthly mortgage payment. 🏡💰 Rising rates in both sectors are reshaping household budgets and creating challenges for homeowners everywhere.

Why Are Costs Rising?

✨ Insurance Premiums:

Severe weather events, such as hurricanes, wildfires, and floods, are becoming more frequent and intense, leading to higher rebuilding costs. This, combined with inflation, has driven insurance premiums to record levels. Homeowners are feeling the strain as these essential expenses climb year over year.

✨ Property Taxes:

The booming housing market has led to increased property valuations. While rising home values can be a good thing for equity, they also result in higher property tax assessments, leaving many homeowners with unexpectedly large tax bills.

What You Can Do:

Here are some practical steps to manage these rising costs:

✅ Review Your Insurance Policy: Regularly assess your policy to ensure you’re getting the best coverage for your dollar. Compare rates from different providers and consider bundling policies for additional discounts.

✅ Appeal Your Property Tax Assessment: If you believe your home’s assessed value is inflated, consider appealing your property tax assessment. Research comparable home values in your area and provide documentation to support your claim.

✅ Budget for These Costs: Incorporate insurance and property tax increases into your financial planning to avoid surprises. Setting aside funds in advance can help you stay financially secure.

Let’s Start the Conversation!

Are you feeling the pinch from these rising expenses? Share your thoughts and strategies below. Whether it’s a creative budgeting tip or an experience with appealing a tax assessment, your insights could help fellow homeowners navigate these challenges. 🔽

Categories

- All Blogs (743)

- 15 Must-Ask Questions Before You Buy That House (1)

- 24th Anniversary of the Attack (1)

- 5 Star Review (5)

- 7 Seconds (1)

- Back on The Market (1)

- Back The Blue (14)

- Back To School (1)

- Buyer (12)

- Buyer Guarantee (2)

- Buyers Stop Paying Rent (2)

- Cash Offer (21)

- Commission (4)

- did you know (15)

- Divorce, Death, or Diapers — Life Happens. (1)

- Father's Day 2025 (1)

- Flip Your Own Home (1)

- Floor Plan (1)

- Free Market Analysis (2)

- Fun and Festive (27)

- Hispanic Heritage Month (1)

- Holidays (10)

- Home Buying Tips (6)

- Home Equity (1)

- Home Inspection (7)

- Home Purchase (24)

- Home Sale (16)

- Home Selling Ti (1)

- Home Selling Tips (4)

- Hotlist of Homes (16)

- Independence Day (2)

- Inspection Traps (3)

- Just bought (1)

- korean war (1)

- Meet Your New Favorite Dish (2)

- Military (6)

- Mortgage (11)

- National Day (4)

- National Hire a Veteran Day (1)

- National PTSD Awareness Day (1)

- New Construction Homes (2)

- Pending Buyer (1)

- Price Reduced (1)

- Rebate (6)

- Seller (3)

- Seller's Divorce (2)

- St Thomas Day (1)

- Testimonial (1)

- Thisorthat (4)

- Tunnel To Towers (13)

- Veteran (2)

- We’d Love to Hear From You! (1)

- Wear Red Friday (14)

- What’s Your Home Really Worth? (1)

- Worthy Cause (15)

- 📍 3415 Clover Blossom Cir | Land O’ Lakes, FL (1)

- 🎮 It’s National Video Game Day! (1)

Recent Posts