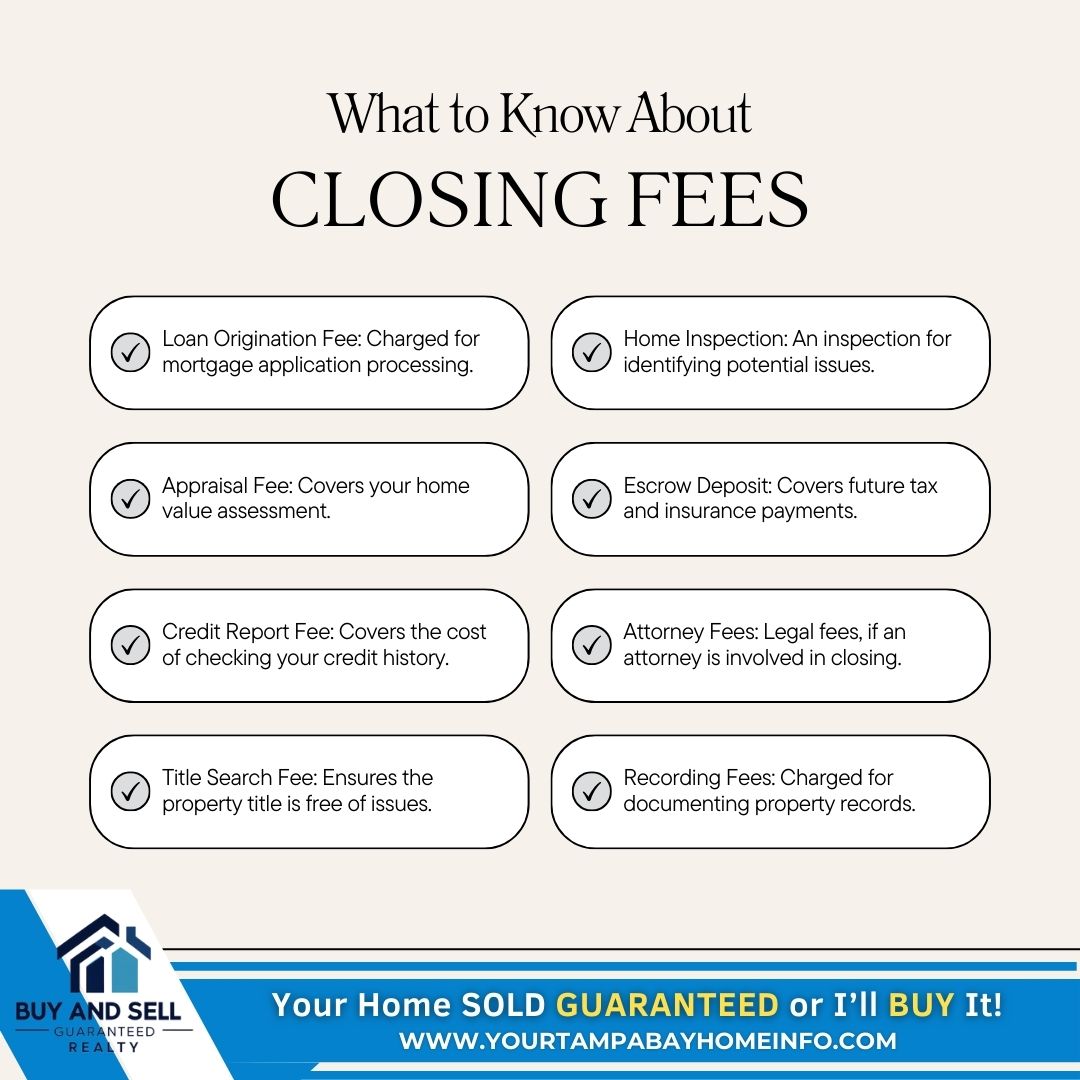

Closing Costs: What You Need to Know Before Buying a Home

Buying a home is an exciting milestone, but before you can officially call it yours, you’ll need to navigate the closing process—including paying closing costs. These fees can add up, so it’s important to be prepared. Let’s break down the key expenses you might encounter.

1. Loan Origination Fee

This fee covers the cost of processing your mortgage application. Lenders charge this to cover administrative costs, and it typically ranges from 0.5% to 1% of the loan amount.

2. Home Inspection

A home inspection helps identify potential issues with the property before you finalize the purchase. While this fee is optional, it’s highly recommended to avoid costly surprises down the road.

3. Appraisal Fee

Lenders require an appraisal to determine the fair market value of the home. This ensures that the loan amount aligns with the property’s worth and protects both the buyer and lender.

4. Escrow Deposit

An escrow account is used to cover future property taxes and homeowners’ insurance. At closing, you may need to deposit a portion of these costs to ensure coverage for upcoming payments.

5. Credit Report Fee

Your lender will check your credit history as part of the loan approval process. This small fee helps them assess your financial reliability and determine loan terms.

6. Attorney Fees

In some states, a real estate attorney is required to handle the closing process. Their role is to review documents, ensure legal compliance, and protect your interests.

7. Title Search Fee

A title search ensures that the property has a clear title—meaning there are no legal claims, unpaid debts, or ownership disputes that could complicate your purchase.

8. Recording Fees

Once everything is finalized, your ownership needs to be officially recorded in public records. This fee covers the cost of registering the deed and mortgage with the local government.

Plan Ahead to Avoid Surprises

Closing costs can vary based on location and loan type, but being aware of these expenses can help you plan ahead. If you have questions or need guidance through the home-buying process, let’s chat! I’m here to help make your journey to homeownership smooth and stress-free. 📩

Categories

- All Blogs (743)

- 15 Must-Ask Questions Before You Buy That House (1)

- 24th Anniversary of the Attack (1)

- 5 Star Review (5)

- 7 Seconds (1)

- Back on The Market (1)

- Back The Blue (14)

- Back To School (1)

- Buyer (12)

- Buyer Guarantee (2)

- Buyers Stop Paying Rent (2)

- Cash Offer (21)

- Commission (4)

- did you know (15)

- Divorce, Death, or Diapers — Life Happens. (1)

- Father's Day 2025 (1)

- Flip Your Own Home (1)

- Floor Plan (1)

- Free Market Analysis (2)

- Fun and Festive (27)

- Hispanic Heritage Month (1)

- Holidays (10)

- Home Buying Tips (6)

- Home Equity (1)

- Home Inspection (7)

- Home Purchase (24)

- Home Sale (16)

- Home Selling Ti (1)

- Home Selling Tips (4)

- Hotlist of Homes (16)

- Independence Day (2)

- Inspection Traps (3)

- Just bought (1)

- korean war (1)

- Meet Your New Favorite Dish (2)

- Military (6)

- Mortgage (11)

- National Day (4)

- National Hire a Veteran Day (1)

- National PTSD Awareness Day (1)

- New Construction Homes (2)

- Pending Buyer (1)

- Price Reduced (1)

- Rebate (6)

- Seller (3)

- Seller's Divorce (2)

- St Thomas Day (1)

- Testimonial (1)

- Thisorthat (4)

- Tunnel To Towers (13)

- Veteran (2)

- We’d Love to Hear From You! (1)

- Wear Red Friday (14)

- What’s Your Home Really Worth? (1)

- Worthy Cause (15)

- 📍 3415 Clover Blossom Cir | Land O’ Lakes, FL (1)

- 🎮 It’s National Video Game Day! (1)

Recent Posts