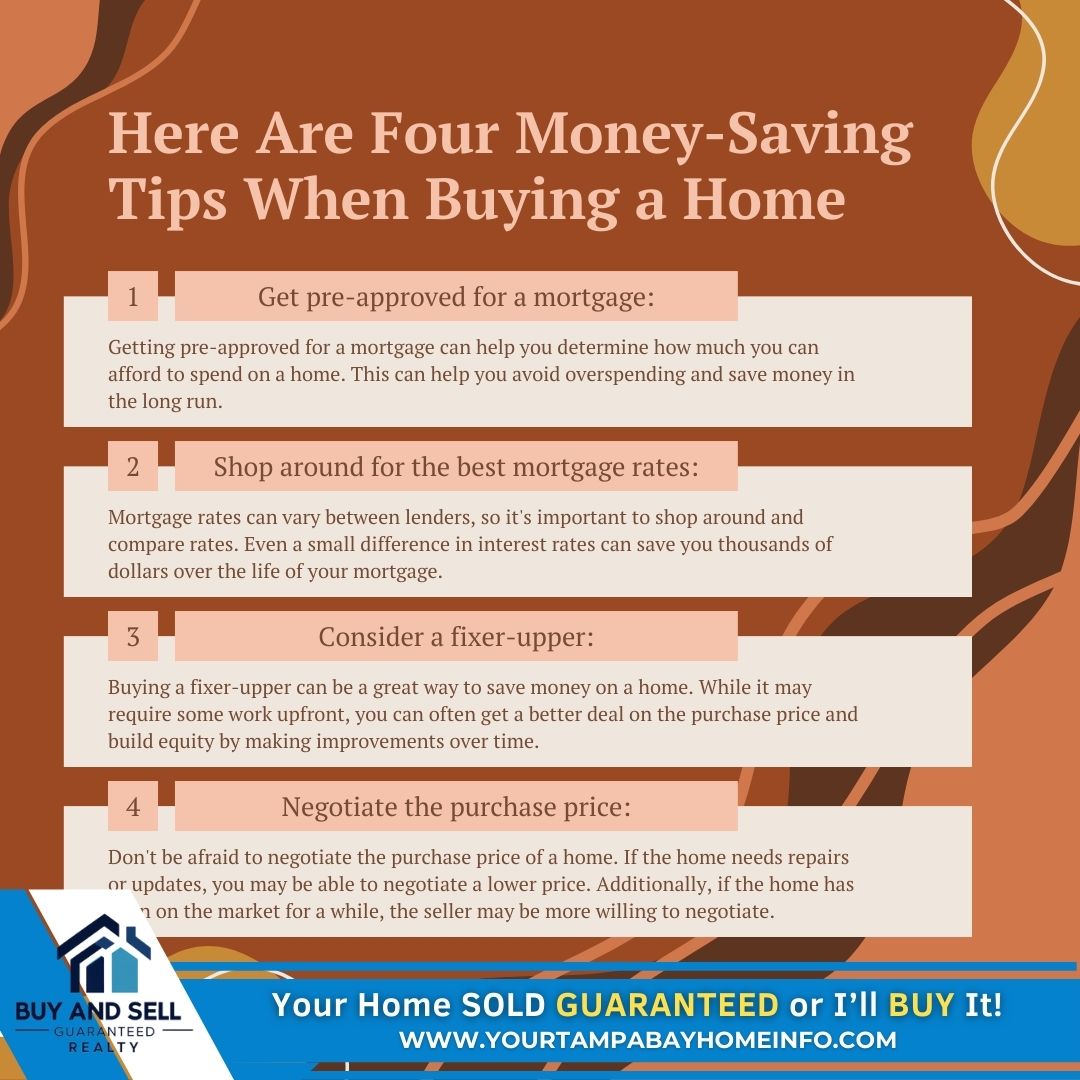

4 Money-Saving Tips When Buying a Home

Buying a home is one of the most significant financial decisions you'll make in your lifetime. While it’s an exciting journey, it’s essential to approach it with a smart and strategic plan to save money wherever possible. Here are four practical tips to help you maximize your savings:

1. Get Pre-Approved

Before you start house hunting, get pre-approved for a mortgage. Knowing your budget not only saves you from falling in love with homes you can't afford but also positions you as a serious buyer. Sellers often prioritize offers from buyers who are pre-approved, which can sometimes give you leverage in negotiations. 🏠

2. Negotiate Closing Costs

Closing costs can add up quickly, but they’re not set in stone. Ask the seller to cover part of the closing costs, especially if you’re in a buyer’s market. Additionally, shop around for better mortgage deals or consider lenders who offer reduced fees to minimize your upfront expenses. 💸

3. Consider Fixer-Uppers

Don’t overlook homes that need a little TLC. These properties are often priced lower and can provide excellent value with a bit of investment. By making improvements over time, you can personalize the space while potentially increasing its future resale value. 🔨

4. Avoid Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is an added cost that kicks in if you put down less than 20% of the home's purchase price. By saving up for a larger down payment, you can avoid PMI and reduce your monthly payments, saving you thousands in the long run. 💡

Final Thoughts

Smart planning and negotiating can go a long way in helping you save big on your next home purchase. By getting pre-approved, negotiating costs, considering fixer-uppers, and avoiding PMI, you’ll set yourself up for financial success and a home you love. 🏡✨

Categories

- All Blogs (743)

- 15 Must-Ask Questions Before You Buy That House (1)

- 24th Anniversary of the Attack (1)

- 5 Star Review (5)

- 7 Seconds (1)

- Back on The Market (1)

- Back The Blue (14)

- Back To School (1)

- Buyer (12)

- Buyer Guarantee (2)

- Buyers Stop Paying Rent (2)

- Cash Offer (21)

- Commission (4)

- did you know (15)

- Divorce, Death, or Diapers — Life Happens. (1)

- Father's Day 2025 (1)

- Flip Your Own Home (1)

- Floor Plan (1)

- Free Market Analysis (2)

- Fun and Festive (27)

- Hispanic Heritage Month (1)

- Holidays (10)

- Home Buying Tips (6)

- Home Equity (1)

- Home Inspection (7)

- Home Purchase (24)

- Home Sale (16)

- Home Selling Ti (1)

- Home Selling Tips (4)

- Hotlist of Homes (16)

- Independence Day (2)

- Inspection Traps (3)

- Just bought (1)

- korean war (1)

- Meet Your New Favorite Dish (2)

- Military (6)

- Mortgage (11)

- National Day (4)

- National Hire a Veteran Day (1)

- National PTSD Awareness Day (1)

- New Construction Homes (2)

- Pending Buyer (1)

- Price Reduced (1)

- Rebate (6)

- Seller (3)

- Seller's Divorce (2)

- St Thomas Day (1)

- Testimonial (1)

- Thisorthat (4)

- Tunnel To Towers (13)

- Veteran (2)

- We’d Love to Hear From You! (1)

- Wear Red Friday (14)

- What’s Your Home Really Worth? (1)

- Worthy Cause (15)

- 📍 3415 Clover Blossom Cir | Land O’ Lakes, FL (1)

- 🎮 It’s National Video Game Day! (1)

Recent Posts