4 Essential Tips for First-Time Homebuyers

Embarking on the journey to homeownership is an exciting milestone, but it can also feel overwhelming, especially for first-time homebuyers. To help you navigate the process, we’ve compiled four essential tips that will set you up for success.

1. Get Pre-Approved for a Mortgage

Before you start house hunting, it’s important to know how much you can afford. Getting pre-approved for a mortgage not only gives you a clear understanding of your budget but also strengthens your offer when you find the perfect home. Sellers are more likely to take your offer seriously if they see you’re already pre-approved.

2. Research & Compare Loan Options

Not all loans are created equal. Take the time to research and compare different loan options. Whether it’s a conventional loan, FHA loan, or VA loan, each comes with its own set of terms, interest rates, and benefits. Choosing the right loan can save you money and provide financial flexibility down the line.

3. Understand the Full Cost of Homeownership

Buying a home is more than just the purchase price. Be sure to factor in additional costs such as property taxes, maintenance, utilities, and insurance. These expenses can add up quickly, so it’s crucial to include them in your budget to avoid any surprises.

4. Don’t Skip the Home Inspection

A home inspection is a must-do step in the buying process. It ensures the property is in good condition and uncovers potential issues that could lead to costly repairs later. Think of it as a way to protect your investment and provide peace of mind.

Start Your Homeownership Journey Today

Taking the leap into homeownership is a rewarding experience when approached with preparation and knowledge. By following these tips, you’ll be well on your way to finding a home that meets your needs and fits your budget. Happy house hunting!

Categories

- All Blogs (702)

- 15 Must-Ask Questions Before You Buy That House (1)

- 24th Anniversary of the Attack (1)

- 5 Star Review (5)

- 7 Seconds (1)

- Back on The Market (1)

- Back The Blue (11)

- Back To School (1)

- Buyer (10)

- Buyer Guarantee (1)

- Cash Offer (18)

- Commission (4)

- did you know (15)

- Divorce, Death, or Diapers — Life Happens. (1)

- Father's Day 2025 (1)

- Flip Your Own Home (1)

- Floor Plan (1)

- Free Market Analysis (2)

- Fun and Festive (22)

- Holidays (9)

- Home Inspection (7)

- Home Purchase (23)

- Home Sale (16)

- Home Selling Ti (1)

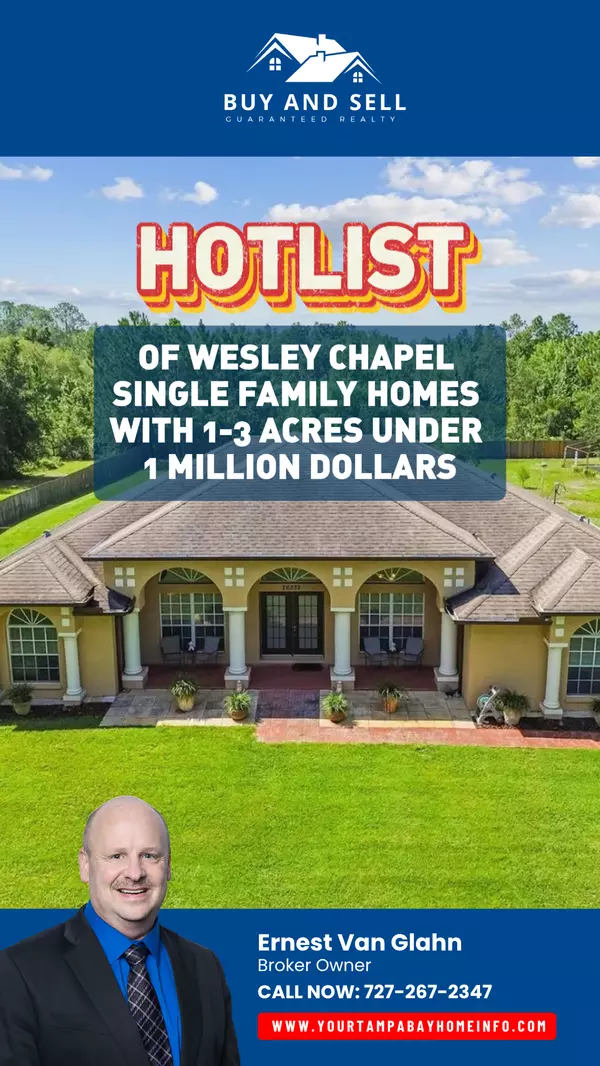

- Hotlist of Homes (12)

- Independence Day (2)

- Inspection Traps (3)

- Just bought (1)

- korean war (1)

- Meet Your New Favorite Dish (2)

- Military (6)

- Mortgage (9)

- National Day (3)

- National Hire a Veteran Day (1)

- National PTSD Awareness Day (1)

- New Construction Homes (1)

- Pending Buyer (1)

- Price Reduced (1)

- Rebate (6)

- Seller (3)

- Seller's Divorce (1)

- St Thomas Day (1)

- Testimonial (1)

- Thisorthat (4)

- Tunnel To Towers (9)

- Veteran (1)

- We’d Love to Hear From You! (1)

- Wear Red Friday (11)

- What’s Your Home Really Worth? (1)

- Worthy Cause (13)

- 📍 3415 Clover Blossom Cir | Land O’ Lakes, FL (1)

- 🎮 It’s National Video Game Day! (1)

Recent Posts