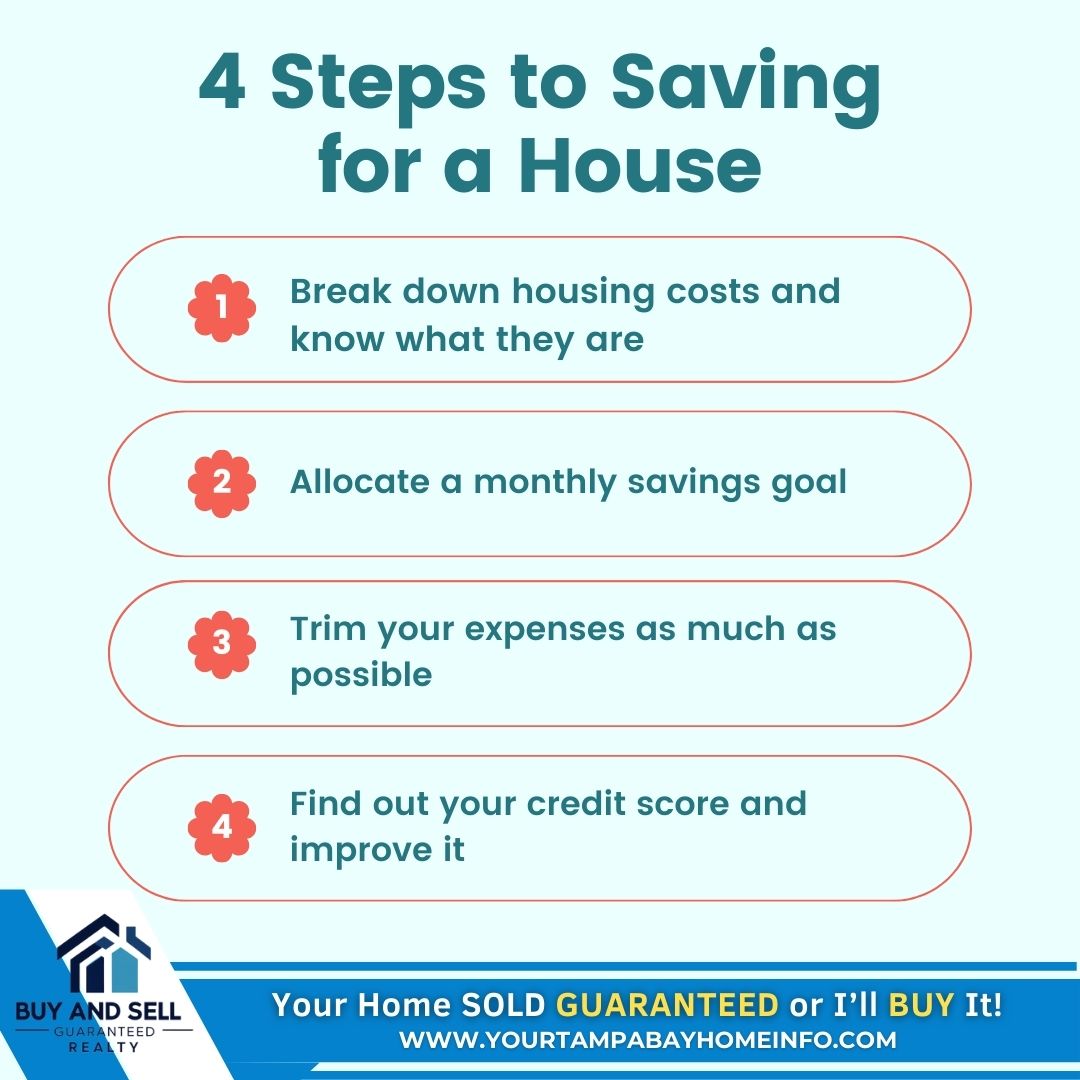

4 Steps to Saving for a House

Owning a home is a dream many of us share, but turning that dream into reality requires careful planning and dedication. If you’re ready to take the leap, here are four practical steps to help you save for your future home:

1. Set a Realistic Budget

The first step in saving for a house is understanding what you can afford. Research the housing market in your desired area and determine how much you’ll need for a down payment and monthly mortgage payments. Don’t forget to factor in additional costs like property taxes, homeowner’s insurance, and maintenance. Once you’ve established a realistic budget, you’ll have a clear savings target to work toward.

Pro Tip: Use an online mortgage calculator to estimate your monthly payments based on current interest rates and your target home price.

2. Open a Dedicated Savings Account

Keeping your house fund separate from your other savings is crucial for staying on track. Open a dedicated savings account specifically for your home-buying goals. This will make it easier to monitor your progress and resist the temptation to dip into the funds for unrelated expenses.

Pro Tip: Look for a high-yield savings account to maximize your savings with better interest rates.

3. Cut Unnecessary Expenses

Small sacrifices can lead to big savings. Review your spending habits and identify areas where you can cut back. Consider dining out less, canceling unused subscription services, or shopping smarter for groceries. Redirect the money you save toward your house fund to accelerate your progress.

Pro Tip: Track your expenses for a month to pinpoint areas where you can cut back.

4. Automate Your Savings

One of the easiest ways to save consistently is by setting up automatic transfers into your dedicated house savings account. Decide on a fixed amount to transfer each month or each paycheck, and let automation handle the rest. This approach ensures you’re saving regularly without having to think about it.

Pro Tip: Schedule your transfers on payday to prioritize saving before spending.

Start Your Journey Today

Saving for a house takes time and commitment, but the rewards are worth it. By setting a budget, keeping your savings organized, cutting unnecessary expenses, and automating your efforts, you’ll be one step closer to opening the door to your dream home.

What strategies have worked for you in saving for big goals? Share your tips in the comments below!

Categories

- All Blogs (743)

- 15 Must-Ask Questions Before You Buy That House (1)

- 24th Anniversary of the Attack (1)

- 5 Star Review (5)

- 7 Seconds (1)

- Back on The Market (1)

- Back The Blue (14)

- Back To School (1)

- Buyer (12)

- Buyer Guarantee (2)

- Buyers Stop Paying Rent (2)

- Cash Offer (21)

- Commission (4)

- did you know (15)

- Divorce, Death, or Diapers — Life Happens. (1)

- Father's Day 2025 (1)

- Flip Your Own Home (1)

- Floor Plan (1)

- Free Market Analysis (2)

- Fun and Festive (27)

- Hispanic Heritage Month (1)

- Holidays (10)

- Home Buying Tips (6)

- Home Equity (1)

- Home Inspection (7)

- Home Purchase (24)

- Home Sale (16)

- Home Selling Ti (1)

- Home Selling Tips (4)

- Hotlist of Homes (16)

- Independence Day (2)

- Inspection Traps (3)

- Just bought (1)

- korean war (1)

- Meet Your New Favorite Dish (2)

- Military (6)

- Mortgage (11)

- National Day (4)

- National Hire a Veteran Day (1)

- National PTSD Awareness Day (1)

- New Construction Homes (2)

- Pending Buyer (1)

- Price Reduced (1)

- Rebate (6)

- Seller (3)

- Seller's Divorce (2)

- St Thomas Day (1)

- Testimonial (1)

- Thisorthat (4)

- Tunnel To Towers (13)

- Veteran (2)

- We’d Love to Hear From You! (1)

- Wear Red Friday (14)

- What’s Your Home Really Worth? (1)

- Worthy Cause (15)

- 📍 3415 Clover Blossom Cir | Land O’ Lakes, FL (1)

- 🎮 It’s National Video Game Day! (1)

Recent Posts